Falling off a perch is not a pleasant feeling for an individual or a company.

However, falling is a trait among warriors, and rising after a fall is a hobby for champions.

For this to happen, an individual or a company needs to be sitting right up to the pile of all other competitors for several years to lose track and fall so hard that the company usually ends up in a bankruptcy file.

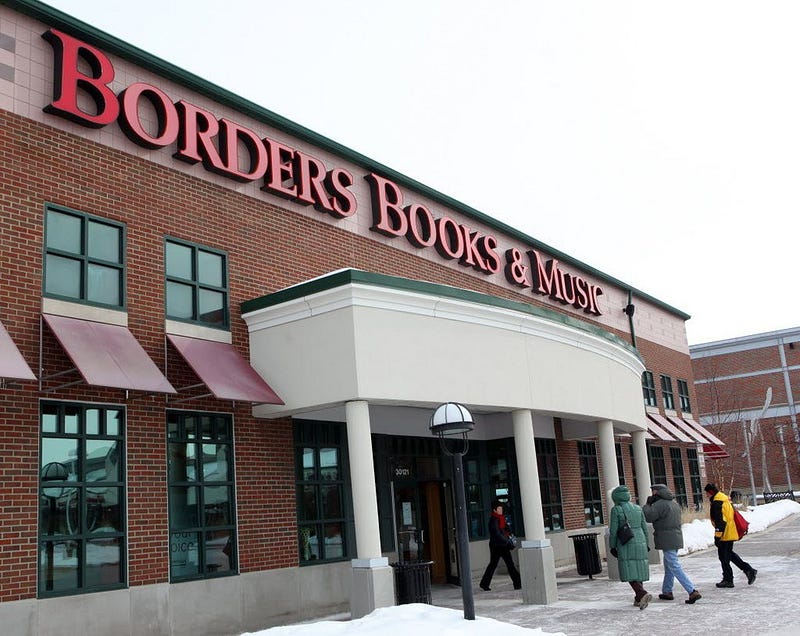

I love bookstores, and visiting Borders at its time was like exploring an Alibaba cavern to discover some unknown treasures.

It’s great to feel, touch, and examine the newest book.

When I buy a book online, I already know what I am looking for. However, when I visit a book store, the task is different. It is an exploration, something unexpected could happen.

Source:

Source: